Introduction

CVS Health Corporation (NYSE:CVS) recently touched down to a 52-week low of ~$60 per share which is a drastic decline from its all-time high of $112 in 2015 translating into a nearly 50% slide in its shape price. Its P/E ratio is in sub-10 territory against an S&P 500 average of 24, suggesting CVS is roughly 60% cheaper than the average stock. Its decline has unfolded in the face several headwinds that have negatively impacted its growth, and the changing marketplace conditions have plagued the stock. Starting in the latter half of 2015 and still unfortunately persisting, the political backdrop was a significant headwind for the entire pharmaceutical supply chain from drug manufacturers to pharmacies/pharmacy benefit managers (i.e. CVS and Walgreens (WBA)) and the drug wholesalers in-between (i.e. McKesson (MCK), Cardinal Health (CAH) and AmerisourceBergen (ABC)). As an extension of the political climate, the drug pricing debate has not subsided and continues to be a hot-button issue weighing on the overarching sector. In an effort to address these headwinds and restore growth CVS has made a bold $69 billion acquisition of Aetna (AET) to form a colossus bumper-to-bumper healthcare company. This new CVS will combine its existing pharmacy benefits manager (PBM) and retail pharmacies with the second largest diversified healthcare company. This is a bold and hefty price tag to pay yet may be necessary to compete in the increasingly competitive healthcare space in the face of drug pricing pressures. CVS is making a defensive yet essential acquisition moving into the future. As CVS transitions and realigns its business to adapt to the changing healthcare space along with Amazon’s (AMZN) competitive threat diminishing, I feel the stock is too cheap to ignore at these levels. Initiating a position near ~$60-$65 may be a substantial long-term investment for long-term value and appreciation.

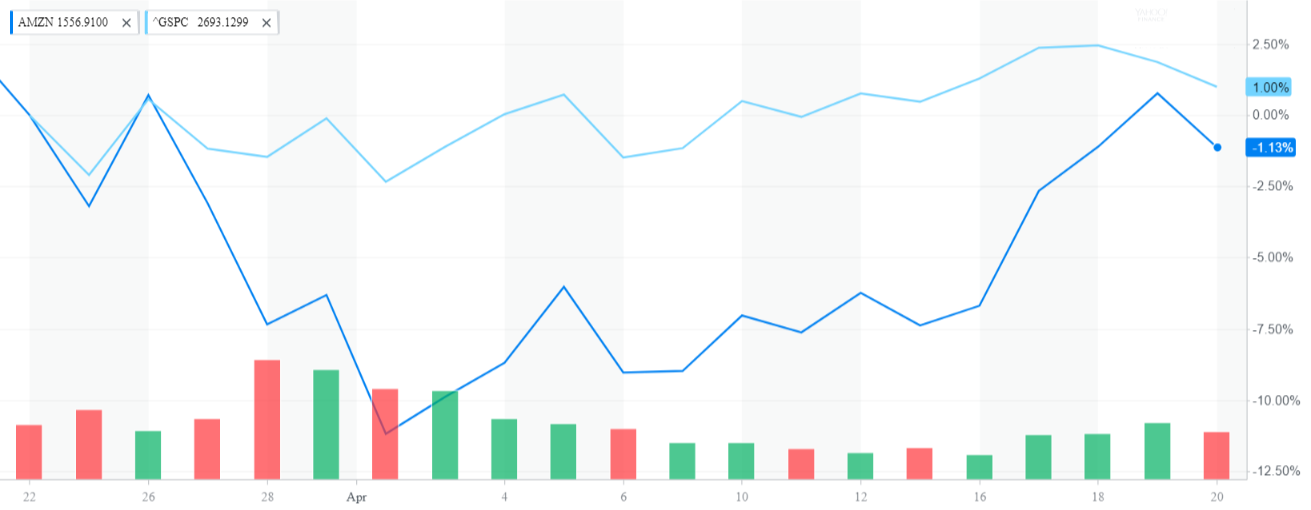

Amazon’s Healthcare Capitulation

Amazon has officially entered the retail space via the Whole Foods acquisition. It had been rumored for months that Amazon was gearing up to gain entry in the potentially lucrative $560 billion prescription drug space by leveraging the Whole Foods storefronts. The speculation was rooted in Amazon’s ramped up hiring and talent acquisition to build an internal pharmacy benefits manager for its own employees. This internal effort was viewed as a proof-of-concept for the broader drug supply chain effort. Amazon has a health team that’s focused on both hardware and software projects, like developing health applications for the Echo and Dash Wand. Its cloud service, Amazon Web Services, continues to dominate the health, life sciences, and technology market as well. Amazon still has the potential with its technology and reach to disrupt the current marketplace however as of now Amazon has decided to not pursue this business in the near future. Continue reading "CVS: Amazon Capitulates - Too Cheap To Ignore?"