The stock market ended Friday trading relatively unchanged, with the DOW closing -28 pts lower or -.10%. The S&P 500 and NASDAQ both finished higher on the day with +.34% and +.37% gains, respectively. The weakness towards the end of the week was tied to stimulus plan news after Treasury Secretary Steven Mnuchin said that "We've offered compromises, the speaker on a number of issues is still dug in, if 'she wants to compromise, there will be a deal. But we’ve made lots of progress in lots of areas, but there's still some significant areas that we're working through."

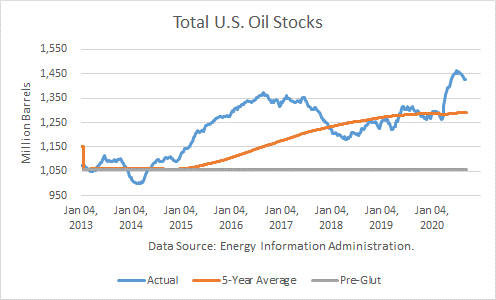

On a weekly level, The DOW and S&P 500 snapped a three-week winning streak with weekly losses of -.95% for the DOW and -.5% for the S&P 500. The NASDAQ had its first weekly loss in five weeks losing just -1%. Rounding out the weekly losses are the US Dollar which lost -1% and crude oil lost over -3%. Continue reading "Stimulus Concerns Stall Market"