I cannot profess to tell others how to effectively manage their accounts because I am a lowly participant who is learning all the time. The truth is that 2019’s learning is much different than 2018’s learning was, which was different than 2016, 2011, 2008/2009 and other pivotal market phases. So I’d say that the biggest lesson to learn has been the concept of marrying adaptability with discipline.

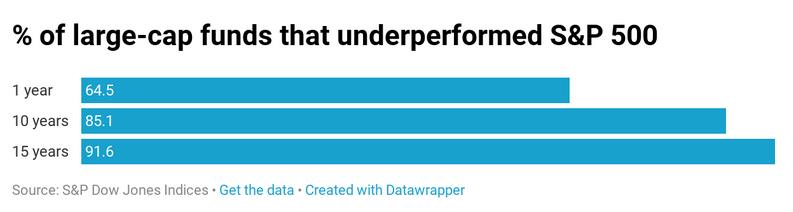

Cookie-cutter advisors and brokers have it easier. They’re the majority of market professionals and they’ve learned and set in stone the way of allocating into markets; 60/40 stocks to bonds or some such variant. But for something more effective than ‘cookie-cutter’, you need to keep learning, adapting and holding discipline as long as your signals remain valid.

As for the current situation and speaking personally, it usually does not work out like this, especially when anticipating a corrective phase in the precious metals. The way it usually works is that I underestimate the intensity of a correction that I am pretty sure is coming and either I don’t sell quite enough, don’t hedge correctly (timing-wise) or don’t balance the portfolios optimally, even if the balancing seemed logical at the time it was undertaken. Often that is because the last market situation is not going to be like the next one. Automatic, cookie-cutter thinking need not apply. Adaptability.

Well somehow today, with gold and silver stocks way off their highs (and GDX & GDXJ painting bogus looking engulfing candles) I am right at my personal portfolio’s value highs for the year despite 2019’s best trade having topped out a couple weeks ago. That is due to some combination of… Continue reading "Market Management 101: Balance"