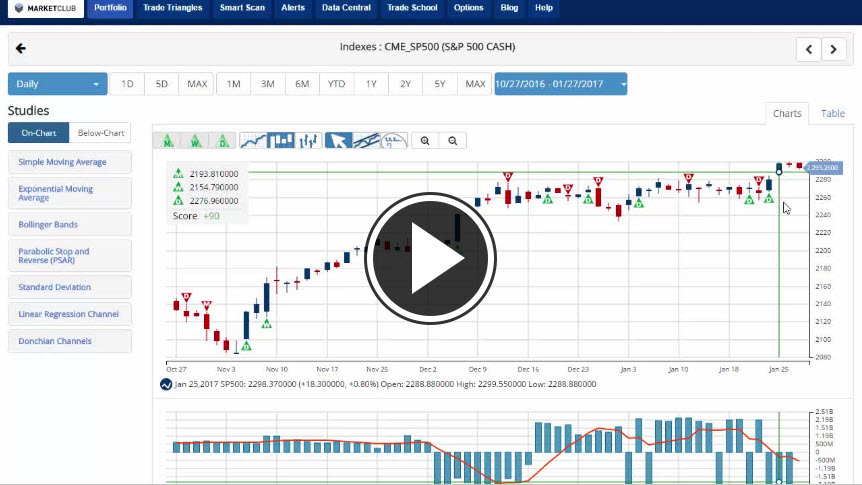

After the S&P 500’s rather flat performance over the first three weeks of January, the Index has finally broken higher, pierced through the 2,280 resistance, and seems well on its way to surge above 2,300. So, the question of potential profit taking for the Index at this time may raise some eyebrows. But if we are to take the signals coming from the Federal Reserve over the past few weeks, this is exactly when we should be worried about profit taking and a jump in volatility for the Index.

While the S&P 500 (CME:SP500) was muddling through over the past few weeks, some attributed it to the protectionist stance of the new US president, e.g. the looming threat of a trade war with China, the risk of import levies and, of course, the latest events of this week. President Trump, in a characteristically dramatic fashion, announced the revocation of the Trans-Pacific Partnership Agreement and proclaimed his intention to renegotiate NAFTA, the North American Free Trade Agreement. And how did investors respond? By pushing the S&P 500 up and out of its stagnation and into a new high. Because, while investors are concerned about the risk of a protectionist trade policy, their concerns are somewhat soothed by Trump’s plan to slash the US corporate tax to 15% and boost infrastructure spending.

But what about the S&P 500 are the bulls ignoring? Continue reading "S&P 500: Prepare For Choppiness"