The collective mind of the Blog's readers has proved to be very powerful as the majority of you guessed it right last time, that the U.S. dollar index (DXY) will reverse down. My assumption that precious metals will start to grow also played out accurately so far, and one could get the clue of DXY reversal from the assumption mentioned above.

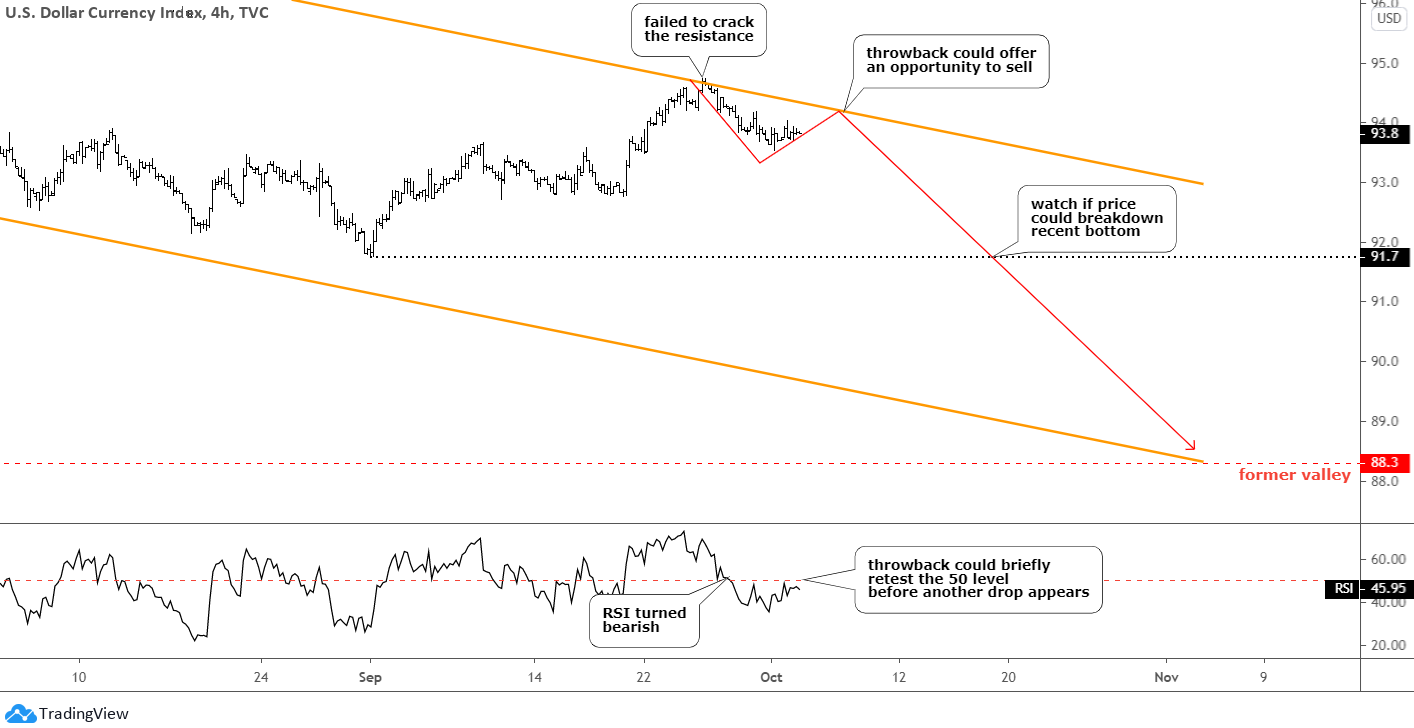

In this update, I added minor annotations for fine-tuning previous charts as I switched to a lower time frame of 4-hour. The final chart below will show you the background for the title of this post. Let us start with the DXY 4-hour chart.

The market indeed saw that orange trendline resistance as the price reversed right at that point. The RSI turned bearish now as it broke below the crucial level of 50. The indicator raises its head together with the price, which could throwback to retest the resistance. The former could briefly overthrow the crucial level, and then it should drop below it again to confirm the Dollar's further weakness. Continue reading "Will Gold Outshine Silver?"