The world of Exchange Traded Funds is massive and growing every day. Whether it’s a simple index fund to a specialty fund that focuses on a very niche industry, you can most likely find an ETF that is right for you. I often tout the S&P 500 index funds for their low cost and how easy they are for a non-financial savvy investor to get into the market and start investing.

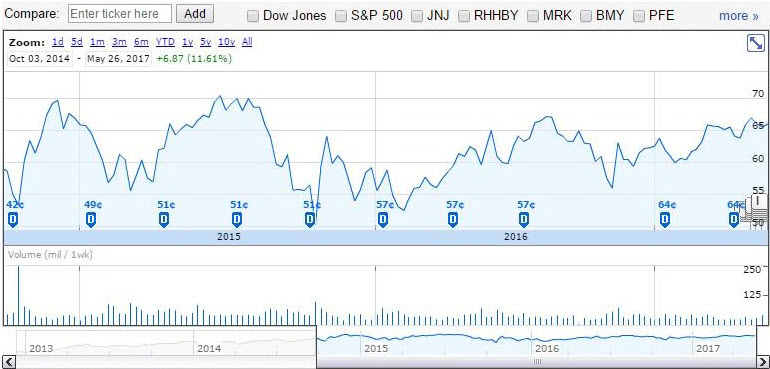

But, for those who have a solid understanding of the markets, the risks, and enjoy finding new investments, I love highlighting the niche ETF's I find. One of my favorite specialty ETF's is the PureFunds ISE Cyber Security ETF (HACK). HACK tracks an equal-weighted index of companies that are actively involved in the cyber security industry.

With the recent global hack that locked users out of their computers and demanded a ransom be paid, the HACK ETF received little attention, while the companies it owns received a lot. That attack once again highlighted the importance of cyber-security and how cyber-attacks are here to stay and will only likely become more prevalent with time. Continue reading "Another Big Cyber-Security Hack, When Should You Buy The HACK ETF"