This week we have a stock market forecast for the week of 4/04/21 from our friend Bo Yoder of the Market Forecasting Academy. Be sure to leave a comment and let us know what you think!

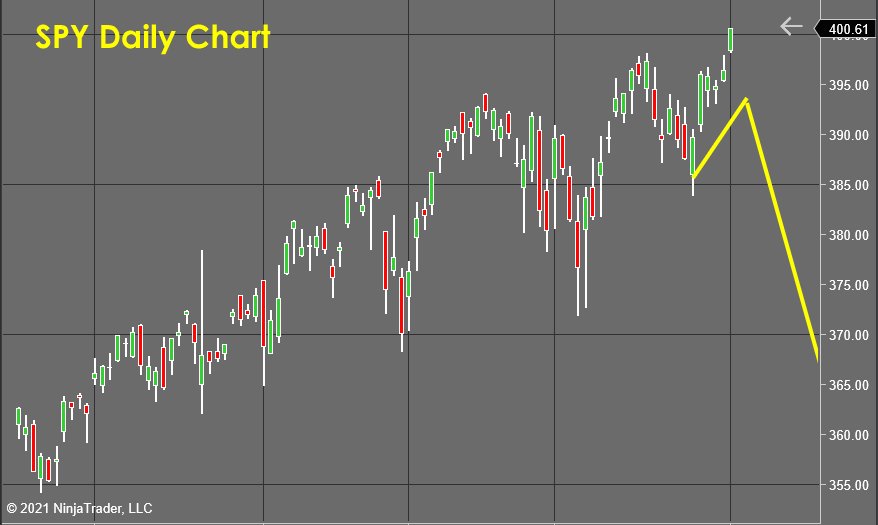

The S&P 500 (SPY)

The news of the new infrastructure/stimulus bill caused the market (analyzed here using the SPY) to react with a gap up and run type candlestick. This surge took out the highs since it seems the Fed will accept a period of inflation as all these new print and spend policies work their way through the economy. The Jobs numbers beat expectations as well, and this also pushed stocks higher. However, the buying hasn’t shown to be connected to a new surge in internal bullish energy, so I’m still expecting to see a topping process begin soon.

With this new upthrust in prices, the head and shoulder pattern I was forecasting for this week has invalidated itself, and I’ll wait to see what profit-taking pressures show up next week before figuring out if this breakout is just simply the head of a NEW head and shoulders formation. Continue reading "Weekly Stock Market Forecast"