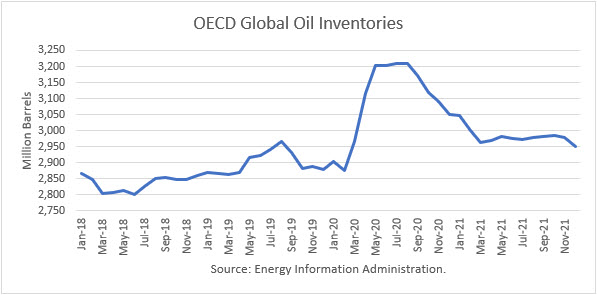

The Energy Information Administration released its Short-Term Energy Outlook for January, and it shows that OECD oil inventories likely bottomed in this cycle in June 2018 at 2.802 billion barrels. Stocks peaked at 3.210 billion in July 2020. In December 2020, it estimated stocks dropped by 40 million barrels to end at 3.061 billion, 172 million barrels higher than a year ago.

The EIA estimated global oil production at 93.45 million barrels per day (mmbd) for November, compared to global oil consumption of 95.59 mmbd. That implies an undersupply of 2.14 mmbd or 64 million barrels for the month. About 30 million barrels of the draw for November is attributable to non-OECD stocks.

For 2020, OECD inventories are now projected to build by net 127 million barrels to 3.006 billion. For 2021 it forecasts that stocks will draw by 95 million barrels to end the year at 2.910 billion.

The EIA forecast was made incorporates the OPEC+ decision to cut production and exports. According to OPEC’s press release on January 5, 2021: Continue reading "World Oil Supply And Price Outlook, January 2021"