Introduction

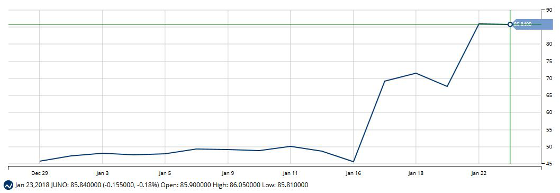

The Biotechnology cohort has finally broken out and reached a 52-week high while making up much of the lost ground during the pummeling from both sides of the political aisle during the 2016 presidential race. Tweets and excerpts from the campaign trail from Hillary Clinton, Bernie Sanders, and Donald Trump put the biotech cohort through the wringer via taking aim at drug pricing. The sustained sell-off lead to the entire cohort to sell off from all-time highs of $132 to $83 or 37% in only six months as measured via the iShares Biotechnology Index ETF (IBB). From February of 2016 through June of 2017 IBB traded in a tight range from $83 to $98 while Donald Trump continually fired shots against the healthcare sector. Any healthcare related stocks became volatile on the heels of any statement or tweet from Donald Trump. Shortly after the inauguration, Trump stated that drug companies are “getting away with murder” when speaking to the drug pricing issue. The previously proposed healthcare legislation never materialized thus a level of certainty has entered the picture, and the drug pricing threats are not perceived to be as bad as initially feared. Recently the index has had a resurgence moving to a 52-week high of $118 with a much clearer runway ahead as the political headwinds continue to abate. As the confluence of abating political threats, drug pricing certainty, merger, and acquisition activity ramps and continuity of the current health care backdrop, I feel the index has room to continue its upward trend and retrace its 2015 level of $130.

AbbVie Earnings Setting the Tone

AbbVie (ABBV) reported Q4 numbers that beat expectations and updated guidance above consensus estimates for 2018, and as a result, the stock moved up 14%. This earnings announcement stroked the entire biotech cohort and had pumped more life into the group that has seen a steady rise leading up to this statement. Other large-cap companies that have plenty of upside based on its multi-year highs include Celgene (CELG) which is off 35%, Regeneron (REGN) which is off 31% and Gilead (GILD) which is off 29% based on current prices. Even specialty pharma Allergan (AGN) is off a staggering 43% as well. All of these names may be due for a resurgence if quarterly results beat and guidance is raised similarly as AbbVie. Continue reading "IBB - Challenging 2016, Recovering 2017 and Resurgence in 2018"