Risks of Saudi Arabia requiring a regime change are increasing, despite the OPEC production and non-OPEC production agreements. Fitch Ratings reduced Saudi Arabia’s rating to A+, the fifth-highest investment grade, and changed the outlook to stable from negative. The downgrade “reflects the continued deterioration of public and external balance sheets, the significantly wider than expected fiscal deficit in 2016 and continued doubts about the extent to which the government’s ambitious reform program can be implemented," Fitch said.

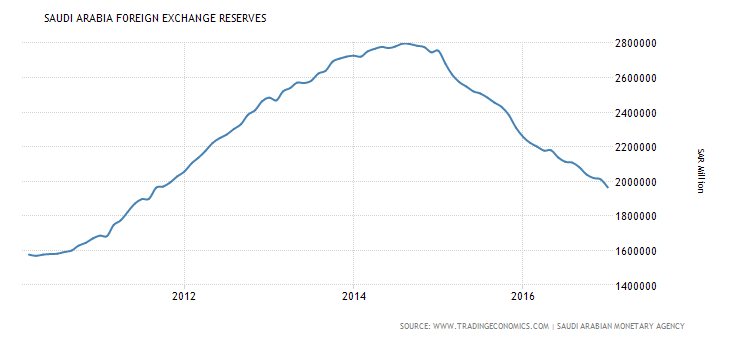

Saudi foreign currency reserves peaked at about $745 billion in 2014. They have dropped to about $525 billion, down $222 billion, or 30%. And despite higher oil prices in January, the reserves fell by $12.5 billion. The IMF has projected that the reserves may be entirely expended by 2020 if world oil prices do not recover sufficiently.

Note: The chart above provides reserves in SAR million

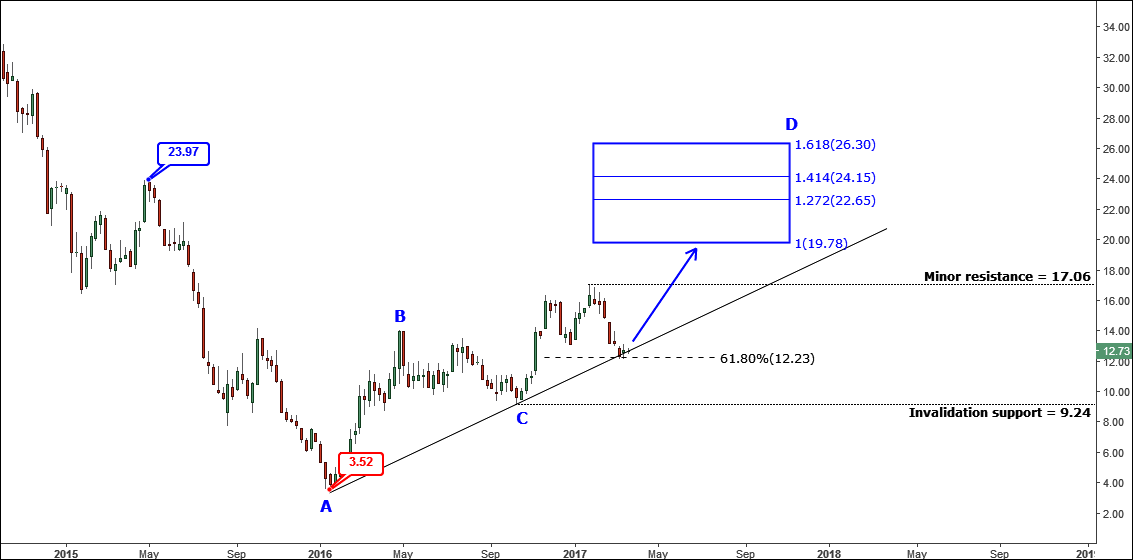

The government had budgeted crude prices in 2017 to average around $53 per barrel. I deduced that from the 2017 Budget of the Kingdom of Saudi Arabia (Page 21): Continue reading "Saudi Arabia's Regime Change Risk"