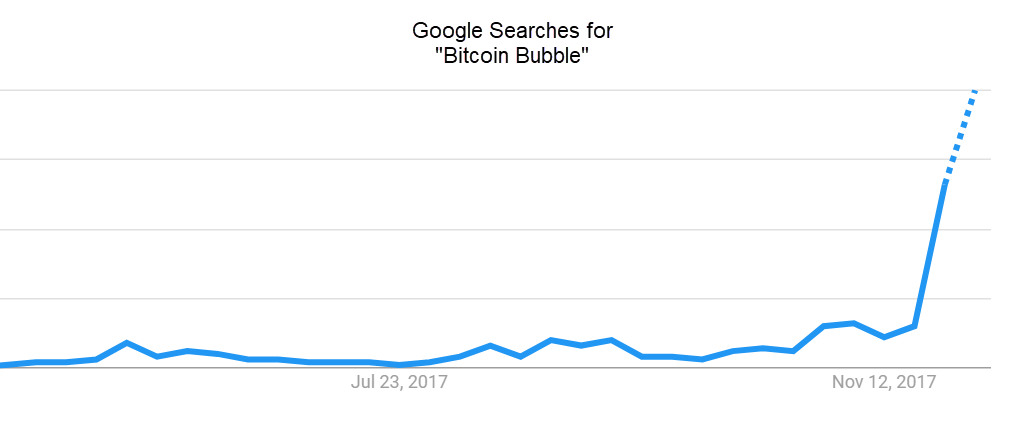

Over the past month, Bitcoin has become almost synonymous with the word bubble. In fact, Google searches for the combination words “Bitcoin” and “bubble” has jumped exponentially. That is unsurprising considering Bitcoin’s phenomenal ascent—piercing through record after record.

Even as calls and forecasts for Bitcoin’s eventual collapse intensify, the enthusiasm has intensified, as well. The cryptocurrency is now available for trading on the Chicago Mercantile Exchange floor, making its way forward as a form of legal tender. It’s also unsurprising, then, that in another Google search, the word combo of “buy” and “Bitcoin” is also at a record high.

So, how can we gauge Bitcoin? We cannot! And that is what I call the Unknown Factor.

Chart courtesy of Google Trends

Bitcoin is No Tulip

Some prominent figures including Jaime Dimon CEO of JPMorgan Chase & Co and John C. Bogle-founder of Vanguard Group. have labeled Bitcoin as a bubble, even the world's most famous investor Warren Buffet has been a skeptic on Bitcoin labeling digital currencies a “mirage.” In fact, most of all, the latest Bitcoin surge is compared to the Tulip Mania that took place way back in the 17th century in the Dutch Republic. Back then, Investors got caught up in a frenzy of tulips and began speculating on their price. A bubble was inflated, and eventually, like every inflated bubble, in 1637 the tulip bubble burst, leaving investors “wounded” and with “hefty losses.” The difference between then and now is that a tulip is, for lack of a better description, a “useless asset.” As a commodity, the tulip, albeit pretty, is nothing more than a decaying flower with no real use or applications in food or industry. Unlike a commodity such as gold or silver, a tulip cannot be used for jewelry.

Continue reading "Bitcoin: The Appetite for the Unknown" →