Gold is okay, but not yet unique

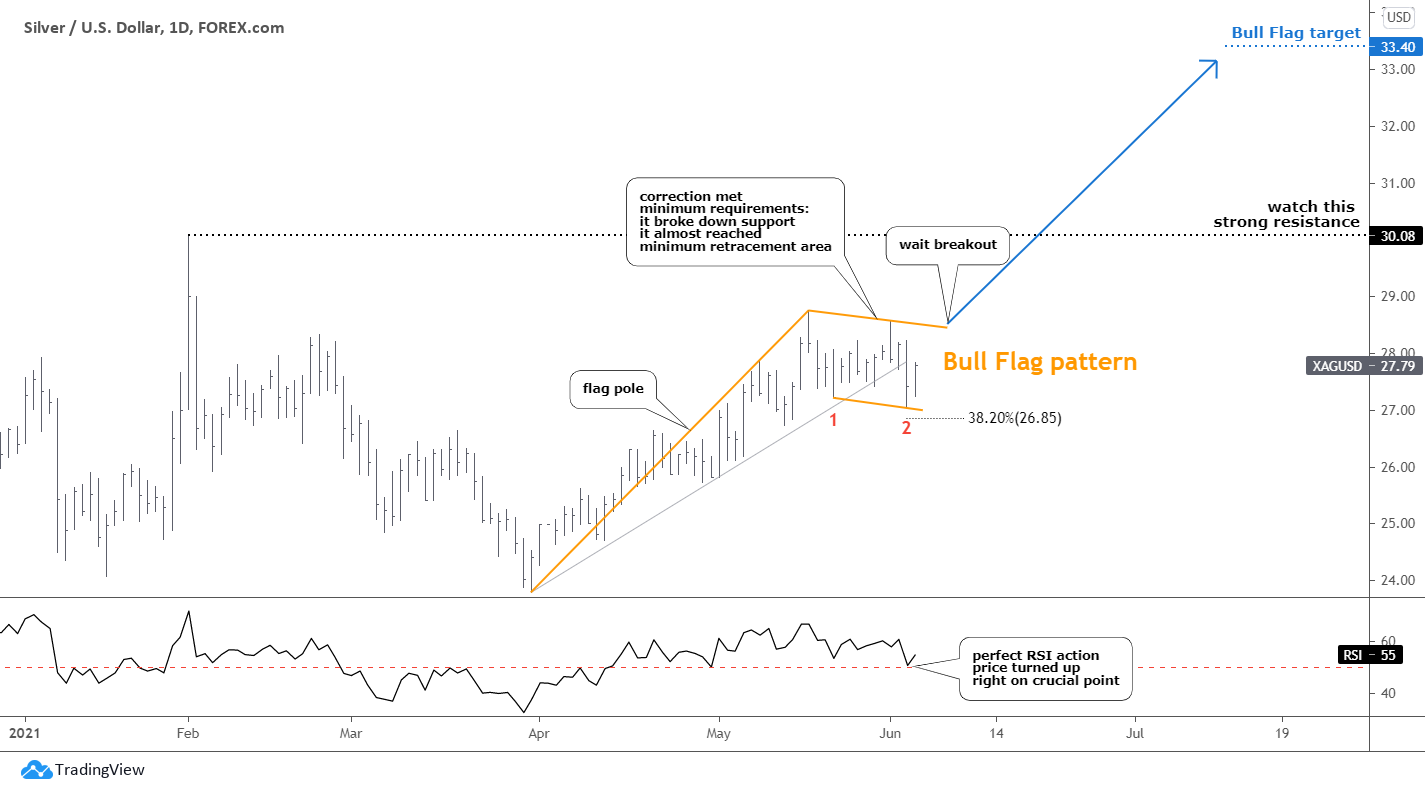

There are times when gold is an okay inflation hedge while under-performing the likes of industrial metals, oil/energy, materials, etc. During those times, if you’re doggedly precious metals focused you should consider silver, which, as a hybrid precious metal/industrial commodity, has more pro-cyclical inflation utility than gold.

But as I have argued for much of the last year, if the inflated situation is working toward cyclical progress (as it is currently) then there is a world full of trades and investments out there to choose from, many of which are trouncing gold (which, as I have belabored for the better part of 2 decades now, is not about price but instead, value) in the inflated price casino.

The latest ISM Report on Business shows one negative among the important areas as employment declined. Now, before we get too excited about that gold-positive reading let’s also realize that manufacturing employment is still growing, new orders are briskly increasing, backlogs are up and customer inventories are down. In short, manufacturing continues to boom.

But being inflation-fueled, the economic recovery also has a ‘prices’ problem… and a materials/supplies problem (unless you’re one of the 2 or 3 people out there with a deep desire to own Acetone. There are potential Stagflationary elements to this situation, which would come forward if the economy starts to struggle due to inflation and the economic pressures it is building. Continue reading "Gold's Inflation Utility" →