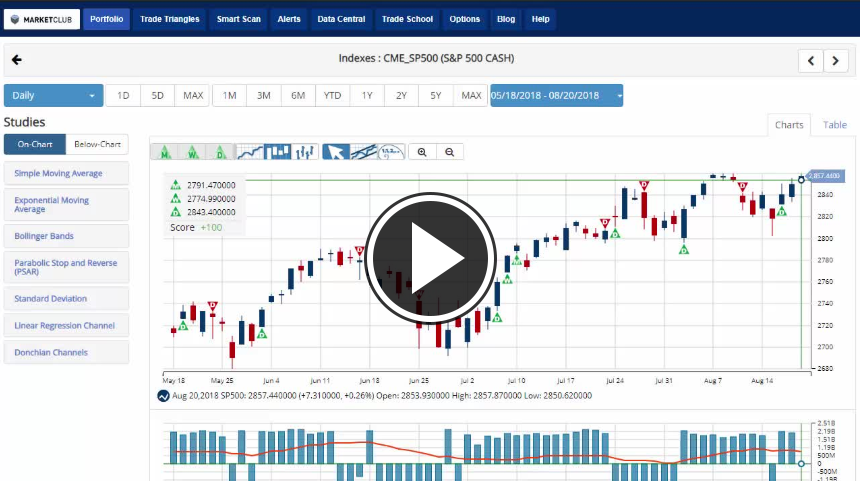

Hello traders everywhere. After a strong finish to last weeks trading the stock market once again opened within striking distance of the S&P 500's all-time high set on on Jan. 26 of this year. In fact, it was sitting just 15 pts shy of that mark in early trading but has since backed off a touch as we enter afternoon trading. However, that's proven to be a tough level to crack.

The reason for last week's mid-week reversal was due to reports of planned trade talks between the United States, and China raised hopes of a potential resolution in the ongoing trade war. Lower-level trade talks will be held on Aug. 22 and 23, according to the Wall Street Journal, just as new U.S. tariffs on $16 billion of Chinese goods take effect, along with Beijing's retaliatory tariffs on an equal amount of U.S. goods.

This week could also be record-setting for the U.S. stocks market for another reason. On Wednesday, the bull market turns 3,453 days old. Barring a 20% decline between now and then, some investors believe it would mark the most extended bull market in history while other investors think that the S&P 500 needs to make a new high by Wednesday for it to become the longest bull market in history. No matter what, the S&P 500 is up over 300% in that time. Quite unbelievable! Continue reading "Trade Talk Optimism Puts Record High In Sight"