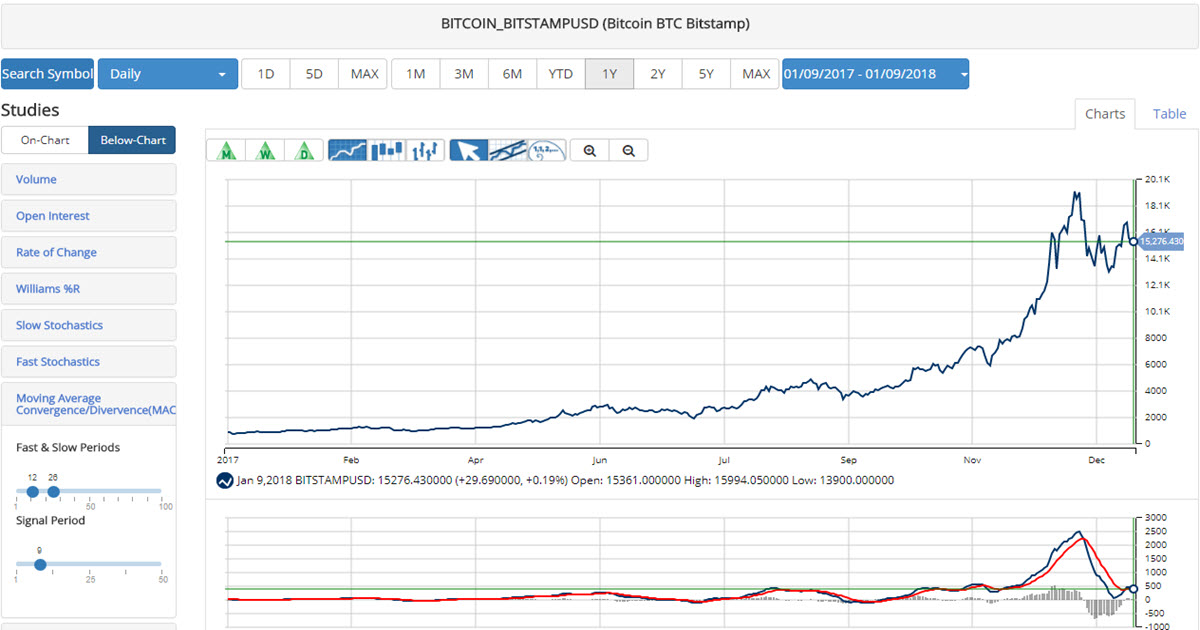

If you look at a chart of Bitcoin during 2017, it really only went higher during the first 11 months. The in the middle of November it was as if the cryptocurrency was strapped to a rocket ship as the price shot higher until mid-December.

While early investors made a killing on Bitcoin in 2017, the real excitement all happened in December. Bitcoin started 2017 at $996, began the month of December at $10,500, then peaked on December 17, 2017, at $19,206, but ended the year at just over $14,000. When Bitcoin hit its peak, it was up nearly 100% for just the month of December, but even after falling $5,000 in only 14 days, it still ended the month up more than 30%.

While Bitcoin may have only risen 30% in December, it increased more than 1,350% in 2017, with nearly 400% of that gain coming in December and 800% of its coming after November 1st. So what happened in the last two months of the year that caused the price of Bitcoin to rocket higher, in such as short period? Continue reading "How Bitcoin Finished An Astonishing Year"