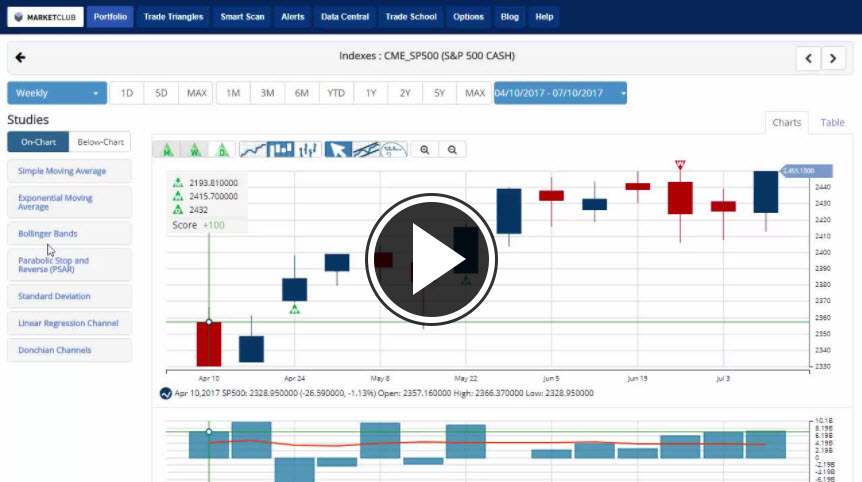

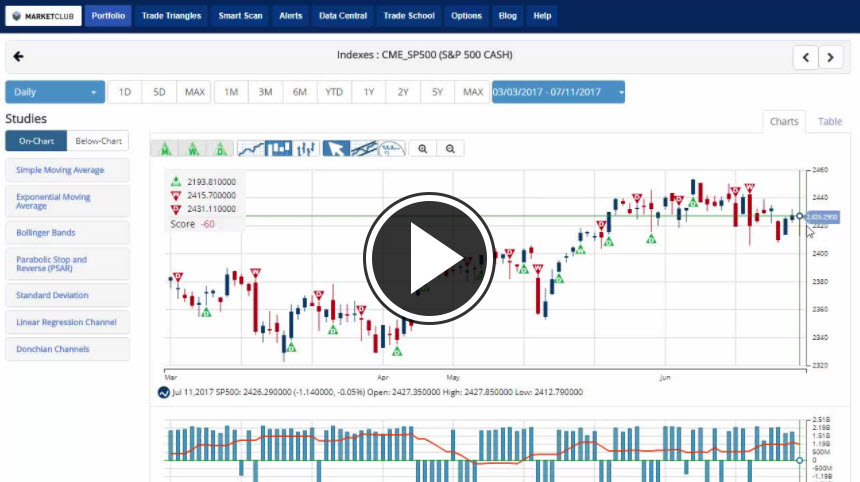

Hello MarketClub members everywhere. As the trading week comes to an end, the DOW and S&P 500 are hovering around their all-time highs with the S&P 500 surpassing that mark as I write this. Weak economic data has also dimmed the chances of another rate hike this year, while lukewarm forecasts by J.P. Morgan and Wells Fargo have limited gains.

EDIT: Shortly after I posted this video the NASDAQ triggered a green weekly TT. Your key level to watch next week is now 6,081.96. A move below that level would issue a new red weekly TT.

Shares of J.P. Morgan Chase & Co. (NYSE:JPM) fell 1.3%, Citigroup Inc. (NYSE:C) was down 1% and Wells Fargo & Company (NYSE:WFC) fell 1.8%, despite their quarterly profits beating analysts' expectations.

Gold and crude oil are both posting weekly gains of 1.3% and 5.2% respectively.

Key levels to watch next week: Continue reading "Indexes Hover Around All-Time Highs"