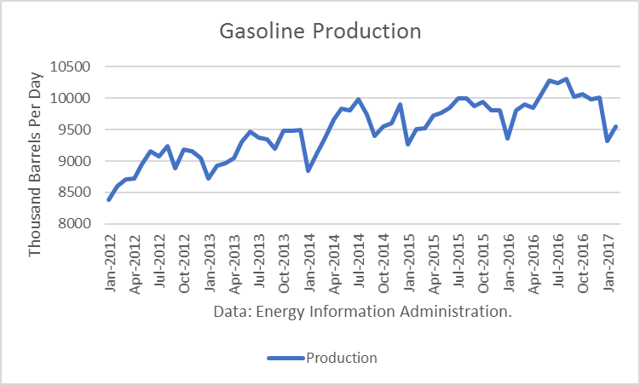

The Energy Information Administration (EIA) reported that gasoline stocks had “surprisingly surged despite heavy driving on the Memorial Day weekend.” But the 3.3 million barrel build was actually not that surprising, given the development of gasoline production capacity and the relative softness of gasoline demand.

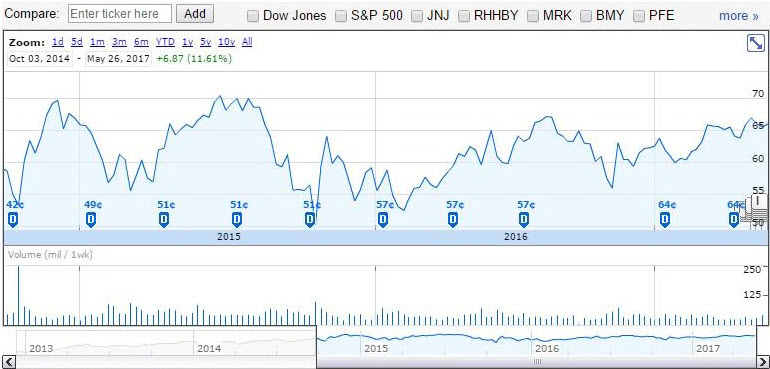

Over the past four years, the U.S. refining industry expanded its gasoline production capacity in the United States by almost one million barrels per day. In 2013, production peaked at just below 9.5 million barrels per day. Last year, production peaked at 10.3 million. And this summer production could reach 10.5 million.

Gasoline demand growth has lagged. Peak demand in 2013 was just above 9.1 million. Last summer, demand peaked at 9.6 million, an increase of about one-half million.

But in the year-to-date, gasoline demand has been 2.9% lower than over the same weeks in 2016. Retail gasoline prices dropped to low levels in the first quarter of 2016, when crude oil prices were bottoming, and that created a surge in demand that was not repeated in 2017. Continue reading "Why The U.S. Gasoline Stock Build Was Not Surprising"