Dear INO.com Readers,

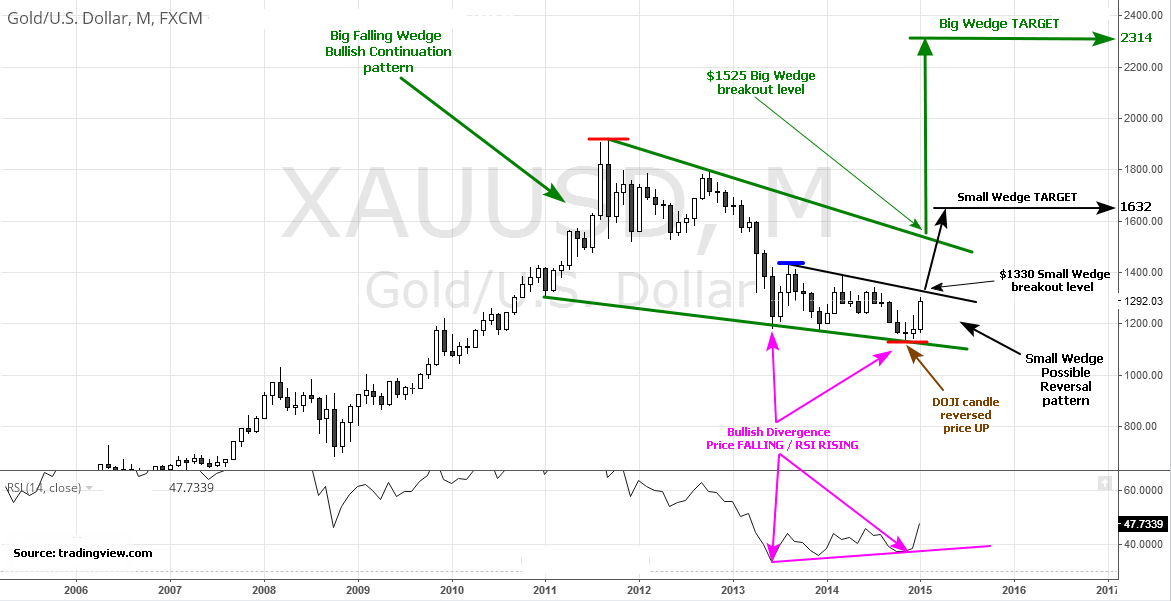

Today, I'm reviewing three metals based on short-term analysis.

Copper Is A Good Sell

In my January post, I recommended selling copper above $2.75 and I hope you enjoyed a nice profit. For those of you who didn’t take that chance, below is my new one for you.

In December, copper entered a small steeper downtrend (highlighted in red) as the falling price accelerated. After breaking below the descending triangle’s base at $3.02 on the monthly charts, this red metal hit a multi-year low at $2.42, unseen from 2009, losing an impressive 20% in just 2 months. The price met the downside of the channel and quickly bounced off for a $0.20 gain and I will show why you should consider it a dead cat bounce. Continue reading "Short Copper, Pray For Gold, Watch Ratio"