“The following is an excerpt from Tim Snyder’s “Weekly Quick Facts” newsletter. Tim is an accomplished economist with a deep understanding of applied economics in energy. We encourage you to visit Matador Economics and learn more about Tim. While there, you can sign up for his completely free Daily Energy Briefs and Weekly Quick Facts newsletters.”

Truth, once again leads our headlines? Over the last two weeks, I have been busting my hump to prepare a presentation for an energy group, having a conference and I really dug deep to pull the data that really made sense for those who don’t ever see all the facts.

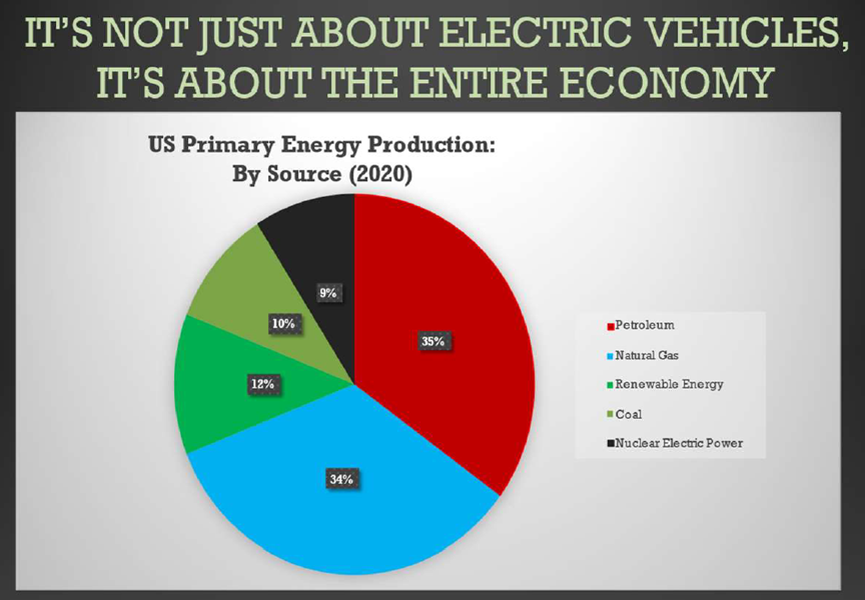

I went to 25 or 30 different sources and grabbed “Snippets” of data to use in my presentation and a solid theme began to develop. The theme was this, it’s not just about the EVs, it’s about the entire energy balance and how many BTUs it would take, to replace fossil fuels in the entire US economy. Here’s how much we produce by sector, each year.

Demand in Quads, by Sector. Continue reading "Truth Is, It's Not Just About Fueling EVs"