The Energy Information Administration reported that November crude oil production averaged 12.879 million barrels per day (mmbd), up 203,000 b/d from October. In addition, the October estimate was revised 21,000 b/d higher, and so the total gain was 224,000 b/d from the prior estimate.

The Gulf of Mexico rose by 91,000 b/d to 1.995 million barrels per day. Texas production reached a new high of 5.329 mmbd, up 65,000 b/d from October. And New Mexico’s production gained 59,000 b/d to 1.063 million barrels per day.

Plains All American Pipeline LP’s (PAA) Cactus ll pipeline was expected to ship at full capacity, 670,000 b/d, beginning in September. EPIC Midstream’s crude oil pipeline began shipping 400,000 b/d. It is designed to ship 440,000 b/d from the Permian and another 150,000 b/d from the Eagle Ford.

Phillips 66 Partner’s Gray Oak pipeline is expected to ship an additional 900,000 b/d. It began shipments and is expected to be in full service by the end of the first quarter of 2020.

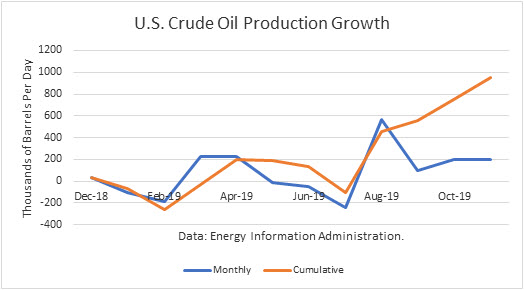

The gains from last December have amounted 953,000 b/d. And this number only includes crude oil. Other supplies (liquids) that are part of the petroleum supply add to that. For November, that additional gain is about 500,000 b/d. Continue reading "Strong US Crude Production Growth In November"