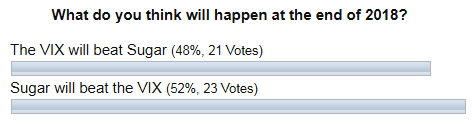

Another half of a year passed with a new year starting its track. It is time to see the result of the 6th Pendulum swing started in the middle of 2018. To remind you, we had pitted the VIX against sugar and below are your bets for that experiment.

You are the best readers I could only dream of as you support my experiment with your real votes for the success of it.

Let’s see which instrument won at the end of the year.

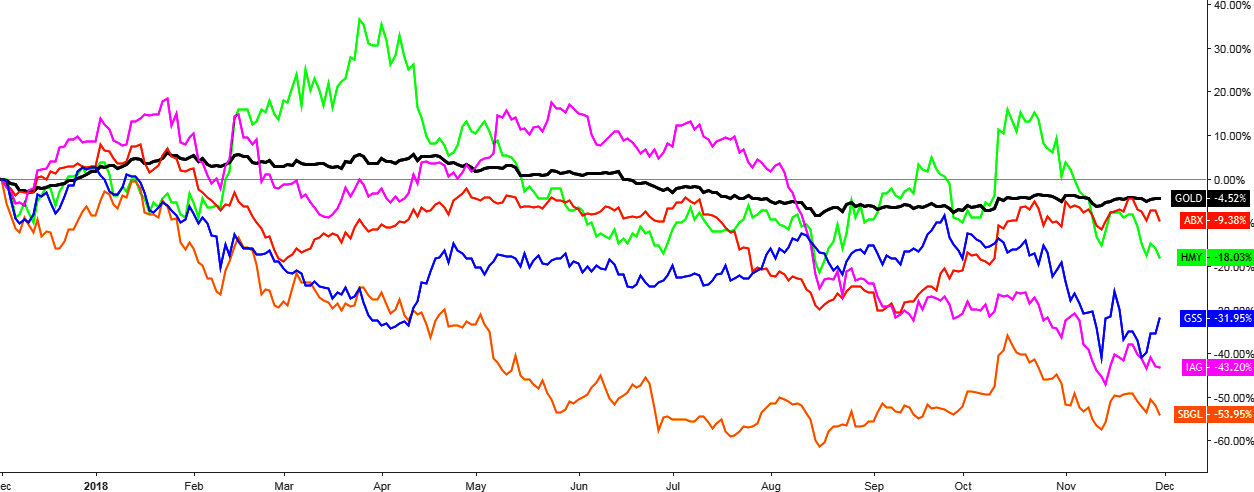

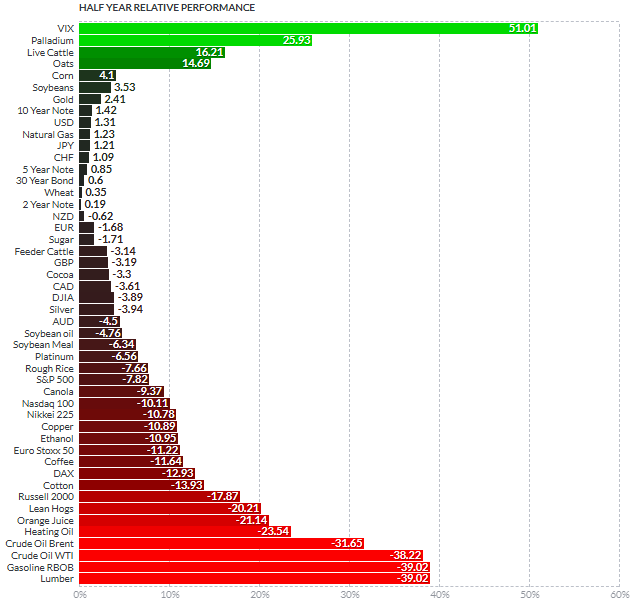

Chart 1. Half Year Futures Performance (Second Half Of 2018)

Chart courtesy of finviz.com

As we can see from this half-year, performance chart sugar couldn’t beat the VIX, which dominated the futures market by a huge margin throughout 2018. One can think that the experiment failed this time, but in my opinion, we have the wrong selection of one input. I am talking about the VIX. The thing is that the underlying asset of these futures is not a commodity, but the “Fear index” or the indicator of the risk approach. Continue reading "Pendulum Swing No.6: Input Error"