Options trading, at its core, is defining risk, leveraging a minimal amount of capital, and maximizing return on investment. Options trading in combination with long equity via broad-based index ETFs and cash-on-hand provides portfolio agility in the face of market corrections and in times of volatility expansion. COVID-19 was the linchpin for the major indices to drop over ~30% in March. Logging the worst sell-off since the Great Depression and inducing extreme market volatility that hasn’t been since the Financial Crisis.

Although options trading provides a margin of downside protection and a statistical edge, no portfolio is immune from the wreckage when hit with a black swan event. Thus proper portfolio construction is essential when engaging in options trading to drive portfolio results. One of the main pillars of building an options-based portfolio is maintaining ample liquidity by holding ~50% of one’s portfolio in cash. This liquidity position provides portfolio agility to adjust when faced with extreme market conditions such as COVID-19 and the September market correction rapidly.

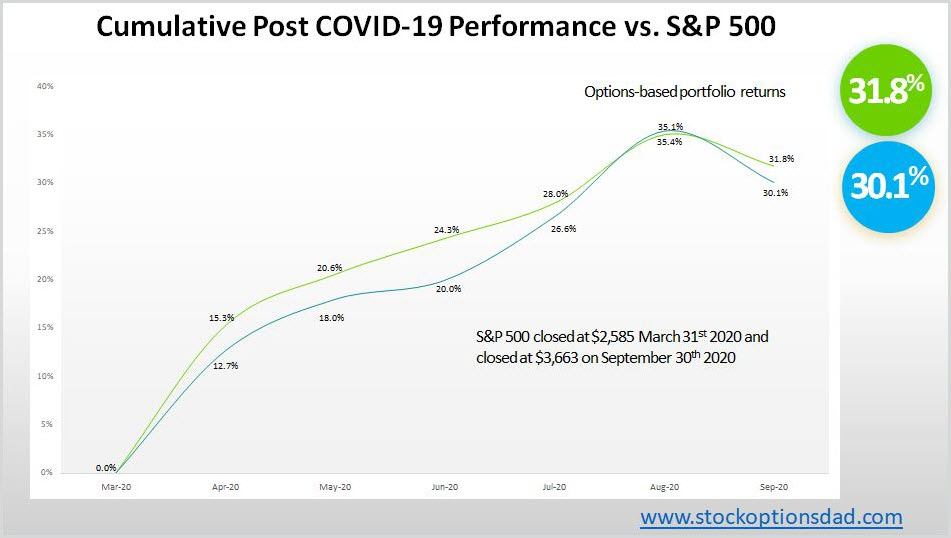

An agile options based portfolio is essential to navigating these pockets of volatility. The COVID-19 induced sell-off and recent September correction are prime examples of why maintaining liquidity is one of the many keys to an effective long term options strategy. In May, June, July, August, and September, 121 trades were placed and closed. Options win rate of 98% was achieved with an average ROI per trade of 7.3% and an overall option premium capture of 90% while outperforming the broader market over the September downturn (Figure 1).

Figure 1 – Smooth and consistent portfolio appreciation while matching the broader market gains and outperforming during the market sell-off in September. An overlay of an options/cash/long equity hybrid portfolio and the S&P 500 post-COVID-19. Even under the most bullish conditions, the hybrid portfolio outperformed the index with ~50% in cash

Continue reading "Options Based Resiliency - September Outperformance"