Hello traders everywhere. Stocks turn mixed after the DOW hit 29,000 for the first time on Friday, ultimately hitting an all-time intra-day high of 29,009.07. Since then, the DOW has turned negative on the day and is down roughly -100 pts or -.3% heading into afternoon trading.

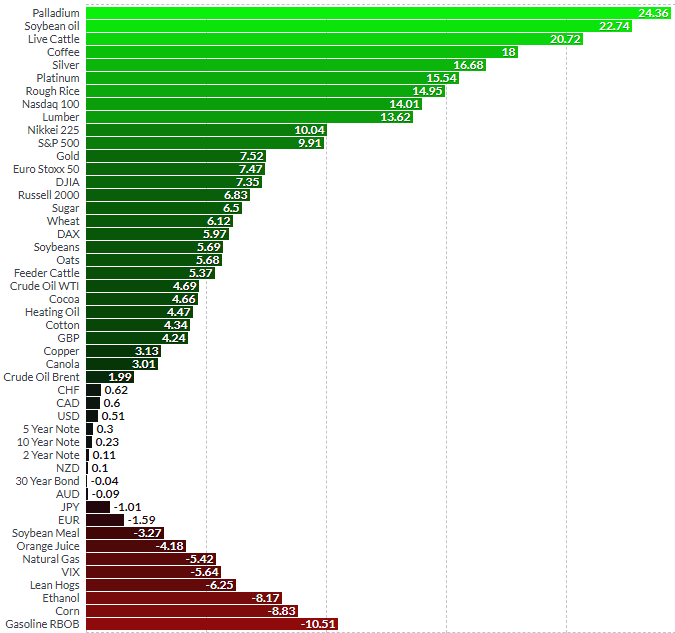

However, the overall weekly picture of the market looks great. The DOW is close to posting a +1% gain sitting at +.95% after hitting 29,000. The S&P 500 will post a gain over one percent with a gain of +1.3%. But they can't compete with the tech-heavy NASDAQ which will post a weekly gain over two percent at +2.1%

The U.S. economy added 145,000 jobs in December. Economists polled by Dow Jones expect the U.S. economy to have added 160,000 jobs in December. Wages also disappointed, growing by just +2.9% on a year-over-year basis. Economists had forecast a gain of +3.1%. December was also the first month since July 2018 that wages grew by less than 3% from the year before. Continue reading "DOW Hits 29,000 For First Time"