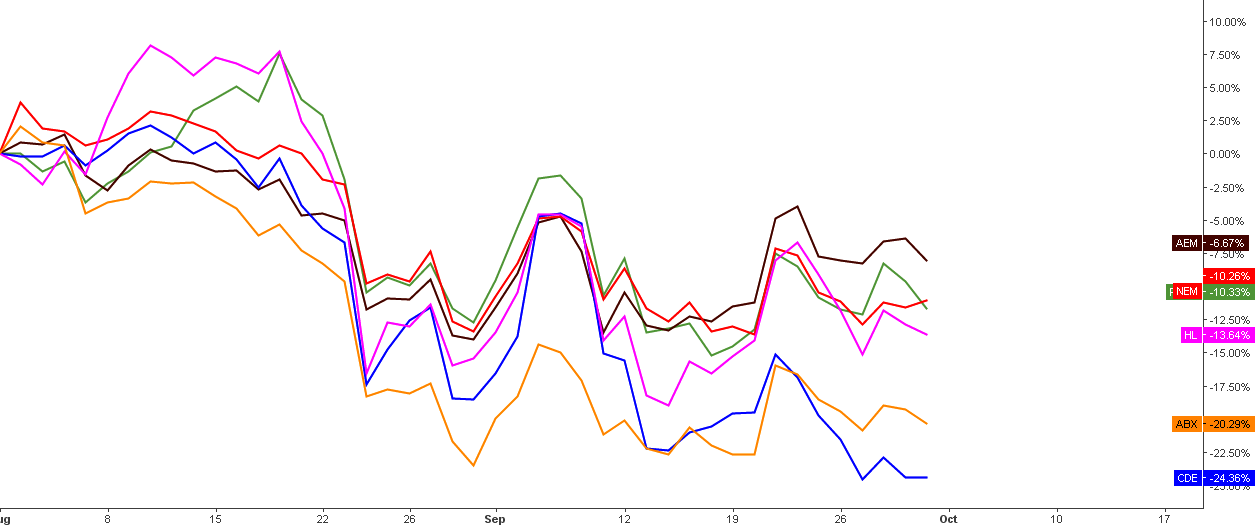

Gold fell below $1,300 yesterday for the first time since the Brexit vote in June, as the dollar index rose to a two-month high.

The dollar rose amid increasing speculation that the Federal Reserve will raise interest rates by December. Both Federal Reserve Bank of Cleveland President Loretta Mester and Federal Reserve Bank of Richmond President Jeffrey Lacker have come out in favor of higher interest rates. Manufacturing data released Monday was stronger than expected.

Also pushing down gold is the U.S. dollar's rise against the British pound, which fell to a 31-year low against the dollar after the release of a timeline for Britain's exit from the European Union. Aiding gold's woes is a rise in Deutsche Bank shares today, signaling at least a temporary easing of worries over the bank's liquidity, and lessening gold's role as a safe haven. Continue reading "Gold Falls on Rate-Hike Fears"