Investors who buy bonds or bond funds are doing so because they want to reduce their risk and preserve their capital. Bonds work very well at doing this when the stock market or economy is declining, but not when economic conditions are strong.

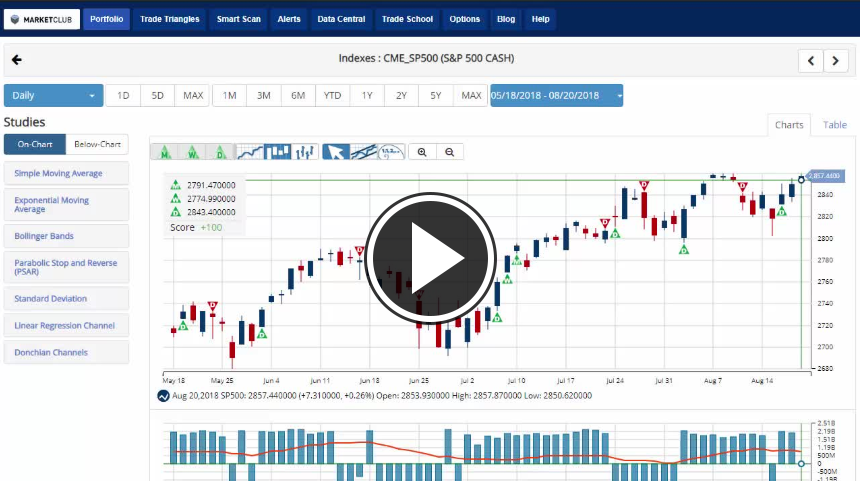

Currently, the US economy is strong with 4% GDP growth, the S&P 500 coming close to setting a new all-time high, the unemployment rate at the lowest level its been in years. All of these indicators point towards the opposite of what bond investors want, especially the need for higher interest rates as inflation continues to creep higher.

Recently JP Morgan Chase’s CEO, Jamie Dimon, said he thought the 10-year Treasury yield should be at 4%, not where it currently sits at the below 3%. He went further and said that 5% interest rates are coming and that investors need to start preparing. Some have argued that interest rates should already be in the 4% to 5% range.

If, Dimon and others are correct in their prediction that higher interest rates are coming than current bond holdings need to “Get out of Dodge” before they get burnt. We have already seen bond funds take a hit in 2018, but if rates do climb as high as 5%, the losses we have seen thus far may dwarf what is to come.

Not surprisingly the best Bond Exchange Traded Funds over the past year are the 3X leveraged short funds. Continue reading "A Few Bond ETFs That Have Performed Well, Despite Rising Interest Rates"