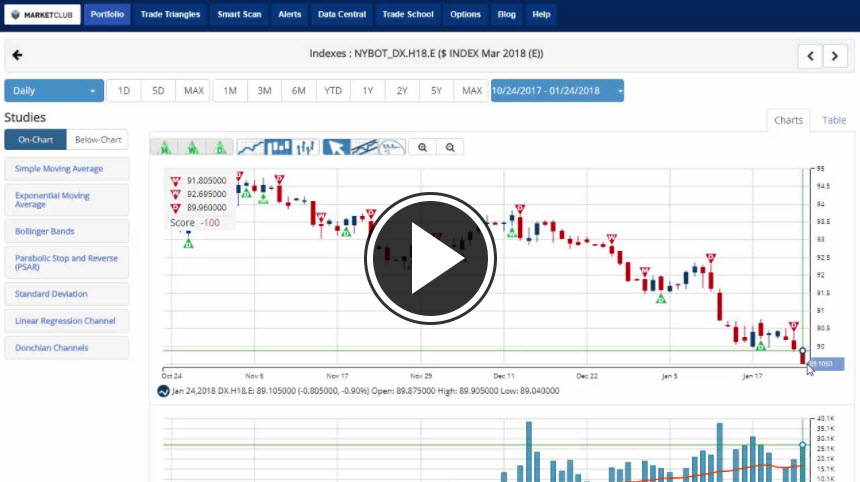

Hello traders everywhere. The U.S. dollar hit new lows on Wednesday after U.S. Treasury Secretary Steven Mnuchin made comments at the Global Economic Forum in Davos, Switzerland, saying that he welcomed its weakness.

Fear of protectionism from the U.S. economy had already pushed the dollar to a three-year low, but Mnuchin's comments added to the pressure that's been pushing it down for the year, with the effects rippling across markets as growth in European and emerging-nation economies continues to accelerate past America.

President Donald Trump is scheduled to arrive and speak at the conference Thursday, and many investors fear that he and his team will continue to talk about a trade war and signal a more protectionist policy stance.

Key levels to watch this week: Continue reading "U.S. Dollar Hits New Lows"