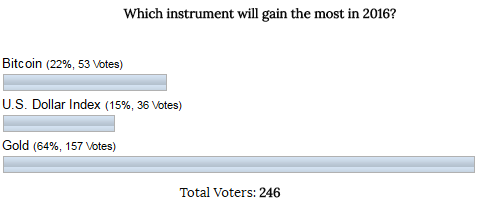

A year ago I wrote about the comparative dynamics of three outstanding kinds of money of different generations – the older generation was represented by gold, the 20th-century generation was represented by the Dollar (Index) and for the modern generation I used the cryptocurrency Bitcoin (BTC). I think some of you have just discovered the serious value of Bitcoin as it just crushed the rivals doubling its value. The dollar index (DXY) gained only 8% as gold showed negative dynamics in 2015. Below I put the result of the poll you voted on a year ago for the 2016 year performance.

Chart 1. Voting results January 2016: You Bet On Safety

I noticed that there are a plenty of gold bugs among regular readers as gold gathered the most votes. The second position went to bitcoin and it shows that there are many modern enthusiasts among our readers. It looks like the least amount of optimism was felt about the US dollar’s future although it didn’t rank the last in 2015. Let’s see, in the chart below who the winner was. Continue reading "This Coin Smashed All...Again...And Again To Pieces!"