We should wait for the market to show us the way by moving the price on the chart with visible changes. I posted the fresh tactical map for both metals 2 weeks ago using the daily time frame. The market is moving within my expectations so far and I decided to post an update using lower time frame charts, which could supplement the picture as no big levels were triggered yet. It would be useful for those who are not yet in the game and are looking for fresh opportunities to enter.

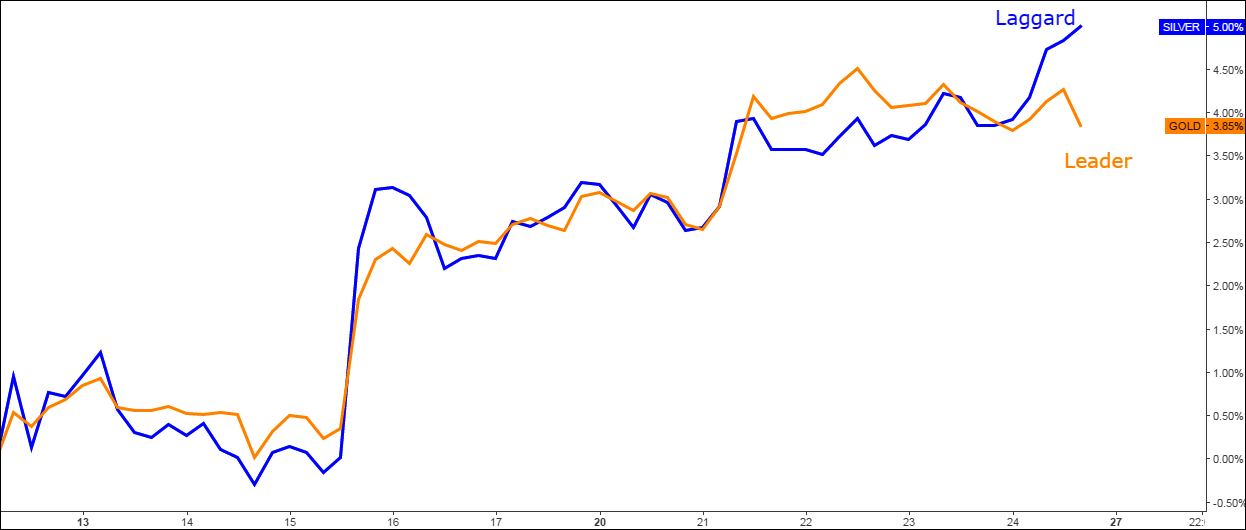

I dedicated the very first chart to the comparison of top metals’ behavior as several times before we witnessed that one top metal signals upcoming changes in the market earlier than the other. Putting them side by side clearly shows the differences in their price behavior, not seen in the separate charts.

Chart 1. Gold Vs Silver 4H: Leader Vs Laggard

Chart courtesy of tradingview.com

The starting period for the chart above was chosen for the low in gold price established on the 10th of March as silver dropped to a new 5 day low later on the 15th of March. It was the first good signal for silver bugs to keep the metal as gold didn’t confirm that drop. Continue reading "Gold & Silver: Gold Was Benched, Silver Is Still In The Game"